AAPL : Photo Gallery

AAPL : Videos

AAPL : Latest News, Information, Answers and Websites

if i buy an option call of aapl at 19.40 for april 16th $325 call is that a smart investment?

does that mean for the 19.40 i spend, 100 shares of aapl will be deliverable april 16th?

Answer: The call option allows you to purchase the 100 shares at the strike price of 325. So if you were to exercise the option, essentially you would be paying 344.40. You need to consider the breakeven points which is the strike price + the amount you paid plus any commissions. If you feel that AAPL stock is worth more than the 344.40 breakeven price than go ahead and make this trade. As a reminder however, this price needs to be achieved before the contract expires which makes options very tricky.

I trade stocks and options so if you would like any advice in the future feel free to shoot me an email.

PS. - My advice is to not buy the contract unless you were hedging it by selling a higher strike option.

Category: Investing

Apple Inc. (AAPL) Beats Q4 Earnings Estimates: Why Is Stock Down?

Apple Inc. (NASDAQ:AAPL) released its earnings report for the three months through September this afternoon. The company showed earnings...

How do I find out how much money I made in the stock market?

In this class at school, we are doing this stock market project. We started out with $10,000 (not real money) and we were supposed to buy at least 3 different shares of stocks. I bought 10 shares of AAPL at $71.32 per share for a total of $713.70, 15 shares of MSFT at $26.72 per share for a total of $400.80, and BKS at $43.07 per share for a total of $430.07. Ive written down the price of each stock everyday. How do I found out how much money I gained or lost?

Answer: Go to Yahoo Finance and enter the symbols of the stock you bought. I'm assuming your project is excluding commission costs, primarily because you made no mention of it.

Here is the link for the AAPL:

http://finance.yahoo.com/q?s=AAPL (you've lost money)

For the MSFT:

http://finance.yahoo.com/q?s=msft (you've lost money)

For the BKS:

http://finance.yahoo.com/q?s=BKS (you've made money)

So get your closing price x the # of shares you bought. Do it three times for your three stocks and you're done.

What grade are you in?

Hope this helps!

--J.

Category: Investing

Is AAPL a buy? - Seeking Alpha

Up to date analysis of Apple Inc. (AAPL) and its stock by hedge fund managers and industry experts. Find out what Apple Inc. is saying about its business from ...

Apple Inc. (AAPL) iPhone ASP, Units Raised But iPad Units Lowered

Apple Inc. (NASDAQ:AAPL) releases its next earnings report tonight after closing bell. Analysts at numerous firms are adjusting their ests.

How do amateur investors LOSE money in the stock market?

If I was a noob, and a stereotypical amateur at buying stocks(iPod is cool - lets buy AAPL!), how could I lose a lot of money investing this way?

And the follow up question - How can I use this as an advantage in my own investing? (if I want to be spiteful yet clever)

Answer: The only way ANYONE loses money in the stock market is by buying a stock for more than they sell it for (excluding possible revenue from dividents)

Some people hang on to a stock even when it is plummeting in the belief that

A: It wont sink that low (wrong, it can go to 0)

B. The company will recover (wrong, they can declare bankruptcy)

C. The stock will always be worth something (wrong, companys can simply invalidate their stock and issue new stock and give nothing to the first stock's owners/investors)

Kmart did exactly that in the early 2000s. The stock was selling around $1 a share, within 6 months dropped off the NYSE sold for around 15 cents a share......Then Kmart declared bankruptcy, made all the current stock worthless and issued new stock.

Category: Investing

I am planning on investing in AAPL and QQQ. Wait until after Greece elections?

I am planning on investing the stock AAPL and the etf QQQ. Do you think that I should make this trade before or after the Greece elections?

Thanks!

Answer: Do you realize that AAPL is 18% of QQQ? Buying both doesn't make a whole lot of sense in terms of diversification.

EDIT: Apologies about the date. Going away for 3 days and already in weekend mode. My bad.

Category: Investing

Is it possible to buy stocks from AAPL or NKE in the UK?

Stocks from the US like AAPL, is it possible to purchase those stocks if youre living in the UK?

Answer: yes its easy ....http://www.hl.co.uk/shares/shares-search-results/a/apple-inc-com-stk-npv

Category: Investing

Stock Market News Today: Big Day for Apple (Nasdaq: AAPL), Merck

Stock market news today delivers a couple big earnings reports, and looks ahead to how the Fed could move stocks on Wednesday…

When do you know when to sell a stock? Any general rules you guys tend to follow?

I’m just starting out with investing and in the last year I’ve purchased a few stocks. Namely stocks in the likes of F, AAPL, HD, BAC, BP, MSFT, etc. My portfolio is currently up roughly 30% but I’m running into analysis paralysis. Anyone have any advice or general strategies for selling? What do you do with the profits? Buy more of the same or put it into a safe place like a CD? Any help developing a strategy would be appreciated.

Answer: Those are all solid stocks with good business models and strong management so you basically should maintain some kind of position in them unless you have an alternate investment opportunity to invest in; so you volatility pump these stocks.

Basically what you do is decide on a ratio between these investments and your riskfree liquid essentially cash available capital. You periodically revisit the portfolio especially after a dramatic change in the market either up or down and you rebalance your portfolio. For example, if you had a $1,000 portfolio with a target of 50% cash, it would start as $500 cash, $500 stock, then if the stock dropped in half you would have $500 cash, $250 stock so you would buy $125 stock to rebalance to $375 cash, $375 stock, then if it returned to it's original price you would have $375 cash, $750 stock leaving you with a portfolio value of $1,125 even though the price is essentially unchanged. Had the stock doubled and then dropped you would've gone from $500/$500 to $500/$1,000, rebalanced by selling $250 to the target $750/$750 and then the stock would drop leaving you with $750/$375 which is again a portfolio value of $1,125. The only flaw is that you encounter commission costs and taxes with the rebalancing trades. This algorithm is called Shannon's Demon after Claude Shannon and it results in you buying low and selling high automatically in a fashion similar to how dollar cost averaging results in buying more low and buying less high.

The proportion of your portfolio that you keep riskfree and liquid is vital to any strategy, it's essentially what introduces a bias between how you are affected when the market goes up versus how you are affected when the market goes down. It's what allows you to take advantage of bargains when the market drops. A good general guideline would be 12% cash, 88% invested. Another good guideline is 43% cash, 57% invested. There are mathematical reasons behind those ratios based on the log utility of wealth and the assumption that there's usually at least one significant market downturn of 60% or more every decade giving a 9.6% chance of a market downturn per year, and a target of 15% yield otherwise. The latter ratio of 43/57 factors in the statistic that the average longevity of a Fortune 500 company is 40-50 years hence there's a 2% per year chance that a good company would fail in any given year. Usually these ratios are taken as 20/80 and 45/55.

Of course, if an alternate investment opportunity crops up and your cashflow analysis shows that you would get a better internal rate of return with the other investment then it may be time to close the position and invest in the other opportunity.

Category: Investing

AAPL: Summary for Apple Inc.- Yahoo! Finance

View the basic AAPL stock chart on Yahoo! Finance. Change the date range, chart type and compare Apple Inc. against other companies.

COMPANY REPORTS; APPLE COMPUTER INC. (AAPL,NMS)

Apple Computer Inc. reported yesterday that its earnings fell 84.3 percent, to $17.4 million, in its second fiscal quarter, despite increased revenues and unit shipments. But the company said that sales of its new Power Macintosh models, introduced in March, were ahead of plan and partly compensated for slowing sales of older machines. Apples

How do I configure a correlation graph and standard deviation on Excel?

I have just downloaded the info I needed off of Yahoo finance into Excel. However, how do I use this info to configure a correlation graph and standard deviation? Im looking to compare TGT to AMZN, BBY, AAPL and GE. How would I do this? And the rest to each other...

Answer: Rather than confuse you with a long diatribe, try this:

Boot up Excel and Click on the HELP MENU. In the little Question box type in " graph standard deviation".

The worlds greatest help menu will take you to a full explanation of how to do it.

Regards

Texian

Category: Personal Finance

Apple Stock Quote AAPL | The Motley Fool

TMF1000 (< 20) Submitted November 29, 2011. Caps price $369.32 I consider Apple was of my favorite long-term investment. With the miss on earnings which ...

AAPL - Apple Inc Stock quote - CNNMoney.com

Apple Inc (NASDAQ:AAPL). Real-Time Quotes. Add to Watch List. Set Alert. 522.01. Real-Time ... Latest AAPL News | Press Releases. 3 Tech ETFs to Watch ...

$AAPL Apple Inc. stock and investing information on StockTwits ...

Real-time trade and investing ideas on Apple Inc. ($AAPL) from the largest community of traders and investors.

What is the meaning in the following AAPL example?

An investor bought 100 calls of AAPL in JAN?

Does it mean that he bought 100 shares of apple?

I think this is about the option market, but i really cant understand the difference between puts and calls, and exercise date??!!

Please give me example, lets say Apple company...

Answer: A call option gives the investor the right to purchase a stock at a specific price before the Call option expires. For example if the investor purchased a call option to buy apple at $400 for Jan. The investor has reserved the right to buy the stock for $400 even if the stock becomes worth $500. The seller also has the right to not execute the call. Basically if the price value of the stock drops to $390, he would not execute the call because it would not make sense for him to purchase the stock at the option price of $400 when it is only worth $390. An option expiring in Jan does not give him until the end of the month, nor the first. Options normally expire the 3rd week of the month but linked is a calender to see the exact dates. Basically a Jan option would have to be executed on or by the 20th. If on the 20th the stock is worth more than the call amount and the investor does nothing a lot of brokers will automatically execute the call, if the stock is at a lost nothing happens and the investor is out the cost of the call.

With all of that stated it would seem to make sense just to buy options, however there is a catch. Options cost money to buy. For example it may cost $20 a share for the call option for apple. If Apple goes to $410, even if the call was for $400 you would have still lost money because the $10 gain cost you $20. In order for you to make money on the call option the stock will need to become worth atleast $420 by the date it expires.

I hope this all makes sense

Category: Investing

How many iPhones do you think AAPL is going to announce sold in the 3Q tomorow?

AAPL announces 3q earnings tomorrow.

Revenue is projected at 8B and 10B in the 4Q for just under 40B for the year.

My question is this :

AAPL keeps "lowering expectations", but raising the # of iPhones it sells.

How many iPhones do you think they will announce tomorrow?

4M? 5M? 6M?

Answer: i say more than 6 million. almost everyone i know has an iphone. when im on my college campus everywhere i turn i see iphones. they are very popular

Category: San Diego

American Association of Professional Landmen

Professionals engaged in land work for oil and gas and mineral exploration and production. Includes events, chapters, certification program, and membership ...

Over half analysts surveyed expect AAPL to beat its own high-end ...

As we wait for Apple to announce its Q4 results in this afternoon's earnings call, more than half of the analysts included in Fortune's survey expect the company to beat its high-end guidance of $37B. The average is driven up ...

Apple Inc. (NASDAQ:AAPL) Analyst Expects Huge Upside From ...

After spending much of the year in negative territory, Apple Inc.'s (NASDAQ:AAPL) stock is almost flat for the year. So, as Apple now releases the new iPad Air to the world, is it too little, too late for the company to regain control ...

Apple Q4 Earnings - Business Insider

Apple's numbers are out, and they're good. Revenue, EPS, and iPhone sales are ahead of expectations. iPad sales were a little worse than expected, but not too bad. The stock initially tanked after the numbers were out ...

I bought a lot of aapl stock 3 months ago, now what to do?

Today, aapl stock has shot up after its quarterly report of earnings. 3 months ago, I bought in just an hour before earnings release cause I felt it would go even higher than the price of $470. As you know the last 3 months have been murderous. Does anyone feel it will return back to the 3 month ago price of $470 or should I cut my losses now?

Answer: Apple stock ALWAYS goes wayyy up during or right after a product announcement and release. Look up the dates for them. They are usually in June (WWDC) or in October. Those are good times to sell. Be patient and wait and you will be rewarded.

Category: Investing

Apple Inc. (AAPL) Buy Tesla Motors Inc (TSLA)? Not Likely

More free advice for Apple Inc. (AAPL). This time it's from Berenberg analyst Andaan Ahmad, who wrote an open letter to Apple CEO Tim Cook.

How much implied volatility is there in AAPL call options before earnings?

I own a few March 2012 call options with a $420 strike. I had planned to hold them through earnings but am concerned that even if AAPL beats, the value of the options will crash due to the IV being removed. Should I sell them prior to earnings release on Tuesday?

Answer: If you think the earnings report is going to be lower than predicted, then bail out but if it comes out higher than expectations, you stand to make lots of bucks.

Category: Investing

APPLE INC (AAPL:NASDAQ GS): Stock Quote & Company Profile ...

APPLE INC (AAPL) stock price & investing information. Find APPLE INC historical stock quotes, key competitors, stock data, executives and company news.

Apple Inc.: NASDAQ:AAPL quotes & news - Google Finance

Get detailed financial information on Apple Inc. (NASDAQ:AAPL) including real- time stock quotes, historical charts & financial news, all for free!

How do you know when a stock is having an increase in users shorting it?

I keep hearing that AAPL is being shorted. What is the statistic to see how heavily the stock is being shorted?

Also, how can you view the range.. Meaning, how can I see that a stock is being heavily shorted from Dec to January?

Is a graph available showing how the stock is being shorted higher as the days go on?

Answer: Short interest is published on a monthly basis. I use shortsqueeze to find out the number of shorts on a stock. The put/call ratio has nothing to do with individual stocks. That just has to do with sentiment and options. Shorting is what hedge funds do to make money on a falling stock. I do not think there are any graphs available.

Category: Investing

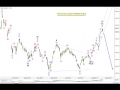

Why does the time scale of your stock charts have to vary in length?

For example, look at the Max-time chart of AAPL, the 5-yr interval of 1985 to 1990 is the widest, 1990 to 1995 the next, then the rest 5-yr intervals are constant.

Answer: you don't say what chart provider you are looking at

Most people don't care about charts over 10 years old....they have little relevance to today

However, here are two charts for Apple Inc.

One has a 10 year interval and the other has a 20 year interval...both are daily charts with no compression

http://tmx.quotemedia.com/charting.php?qm_page=90799&qm_symbol=AAPL:US

http://bigcharts.marketwatch.com/kaavio.Webhost/charts/big.chart?nosettings=1&symb=AAPL&uf=0&type=64&size=4&sid=609&style=320&freq=1&entitlementtoken=0c33378313484ba9b46b8e24ded87dd6&time=20&rand=276312736&compidx=aaaaa%3a0&ma=0&maval=9&lf=1&lf2=0&lf3=0&height=635&width=1045&mocktick=1

it has nothing to do with charting in general but has everything to do with the charting service in particular and they way the archive older...basically useless to current decision making...data

Category: Investing

AAPL Stock Quote - Apple Inc. Stock Price Today (AAPL:NASDAQ ...

Updated stock quote for aapl - including aapl stock price today, earnings and estimates, stock charts, news, futures and other investing data.

Do you have to have a certain amount of cash to trade options at OptionsXpress.com?

Ive decided to try trading options and I have had a bunch of people tell me that optionsxpress is a great place to do so. The thing is that I still like to trade stocks on Scottrade because the commissions are so low and I understand that its more expensive to trade stocks with optionsxpress, but the commissions for trading options with optionsxpress is lower than scottrades. I want to start trading options with a seprate account with optionsxpress and do it with about $3000. Is that too low of an amount? Also, i just want to trade them, not exercise them and mostly just calls on stocks that have high volume in their options (Example:AAPL). Thank you.

Answer: I trade options frequently. You should only use a small portion of your investment assets to trade options. If the 3000 is all you have to invest, I would not recommend putting all of it towards option trades.

If you are only buying and selling calls then you can make plenty of trades on $3,000.

I don't use Scottrade, but I would assume they are pretty inexpensive for their trading fees. I would go with whoever charges the lowest commission. I use Fidelity and I think they charge $8 + $.75 per contract.

Category: Personal Finance

How will AAPL do during the rough holiday season? Need some advice?

I bought AAPL at $90 a share. I love the company and own a bunch of apple products myself. However, with all the news about holiday retail spending at a 25 year low, Im afraid that the stock will drop to the 80s and maybe even high 70s. Should I sell AAPL now or hold on to it?

Answer: Your guess is as good as mine. AAPL could very easily drop. We are in a very difficult retail environment and AAPL is not immune. Nobody is immune. But one thing to consider is the current valuation of the stock. It has not sold this cheaply on an evaluation basis since about 2001. It is certainly a lot healthier company now than it was then.

Category: Investing

How do I check or buy/sell AAPL stock futures?

Ive seen people checking futures while they are thinking of buying/selling a stock. Is there futures for all stocks or just general futures? I guess Im confused on the whole futures thing in general, but I want to see anything corresponding to AAPL in particular. Any help is appreciated. Thanks.

Answer: AAPL does have futures, which trade on the OneChicago. Any broker that allows you to trade futures or Single Stock Futures will allow you to trade these. But these only trade during regular market hours, whereas AAPL stock trade in both premarket and aftehours trading via ECNs like ARCA.

But when people are 'checking futures before they buy/sell a stock', they are looking at what the ES futures (S&P) are doing in pre-market (or after-market) trading. If you assume that your stock will go up or down with the overal market, and the premarket activity in Futures will indicate a strong or weak open, then this is an understandable approach.

Category: Investing

![Apple - AAPL - A Case Study [HD] Part 5/5 - YouTube Apple - AAPL - A Case Study [HD] Part 5/5 - YouTube](http://img.youtube.com/vi/Zm-Zx7MExHA/default.jpg?h=90&w=120&sigh=__p9dBkvx0YHtDIZjwW8174K2DvPw=)